When it comes to providing employees with a comprehensive health benefit plan, it’s important for the employer to consider all parties involved. Some employees may be open to a change in benefits, while others will undoubtedly be hesitant. Every employee has a unique financial situation that will sway his or her opinion, but MidAmerica has found that through candid conversations between decision makers and employees, a win-win arrangement is achievable.

Since the IRS approved the use of the Health Reimbursement Arrangement (HRA) in 2002, MidAmerica has helped public sector employers across the country save on FICA taxes, reduce their OPEB liability, and help employees offset the cost of rising health care. Despite the increasing adoption of the HRA and the recognition of both its cost-saving abilities and administrative flexibility, employees may be hesitant to accept it as a new benefit due to some common misconceptions. If you currently offer an HRA or if you’re looking to implement an HRA for your organization, we understand that getting your employees on board is a large part of the process. Below are some common concerns employees, unions and bargaining groups may have and tips on how to help them understand the long-term benefit of the HRA solution:

Employee Concern: “I don’t need my unused leave for medical expenses—I want to use that money for any purpose I want after I retire.”

Employer Response: “The average 65-year-old couple retiring in 2019 can expect to spend $285,000 in health care and medical expenses throughout retirement[1], which means that without an HRA, you will likely use a tax-deferred retirement benefit or cash payout to cover these expenses. An HRA allows that money to be invested for potential tax-free growth and used tax-free when you incur the inevitable medical costs. Plus, we can set up a unique plan design so that a portion of your unused leave is placed into an HRA while the remaining funds are placed into a tax-deferred retirement plan, like a 401(a) or 403(b) plan, to be used for any purpose you choose. Essentially, you’ll maximize the value of your unused leave to help offset the rising costs of health care in retirement.”

Employee Concern: “It seems like I’m losing money since I’m not receiving a cash benefit.”

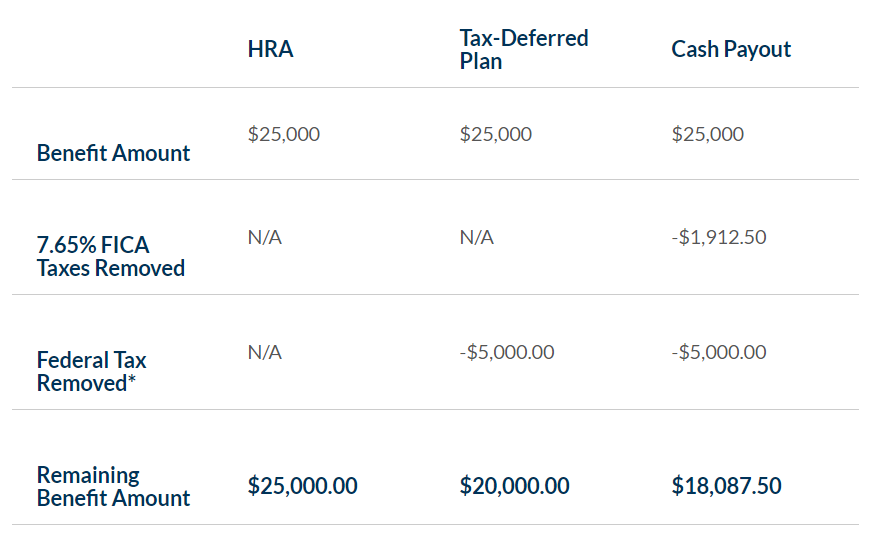

Employer Response: “You’re actually receiving more money since the HRA is tax-free! This means you receive dollar for dollar the benefit amount you are promised. Unlike other retirement plans, the money reimbursed through the HRA is not subject to FICA, Federal, or State income taxes. With an HRA, deposits, accumulation, and reimbursements are all tax-free. In fact, you can easily calculate how much of your total benefit you’d receive based on the benefit vehicle.” Below is an illustration based on a $25,000 benefit amount.

*Based on 20% Federal Tax assumption. Consult your tax advisor for the actual tax rate that would apply to you.

*Based on 20% Federal Tax assumption. Consult your tax advisor for the actual tax rate that would apply to you.

Employee Concern: “Is it true that HRAs do not allow beneficiaries?”

Employer Response: “A participant’s surviving spouse, tax dependents, and qualifying children can still access HRA funds to pay for their own qualifying medical expenses after a participant’s death. Most participants fully spend their HRA balances over the course of their lifetimes.”

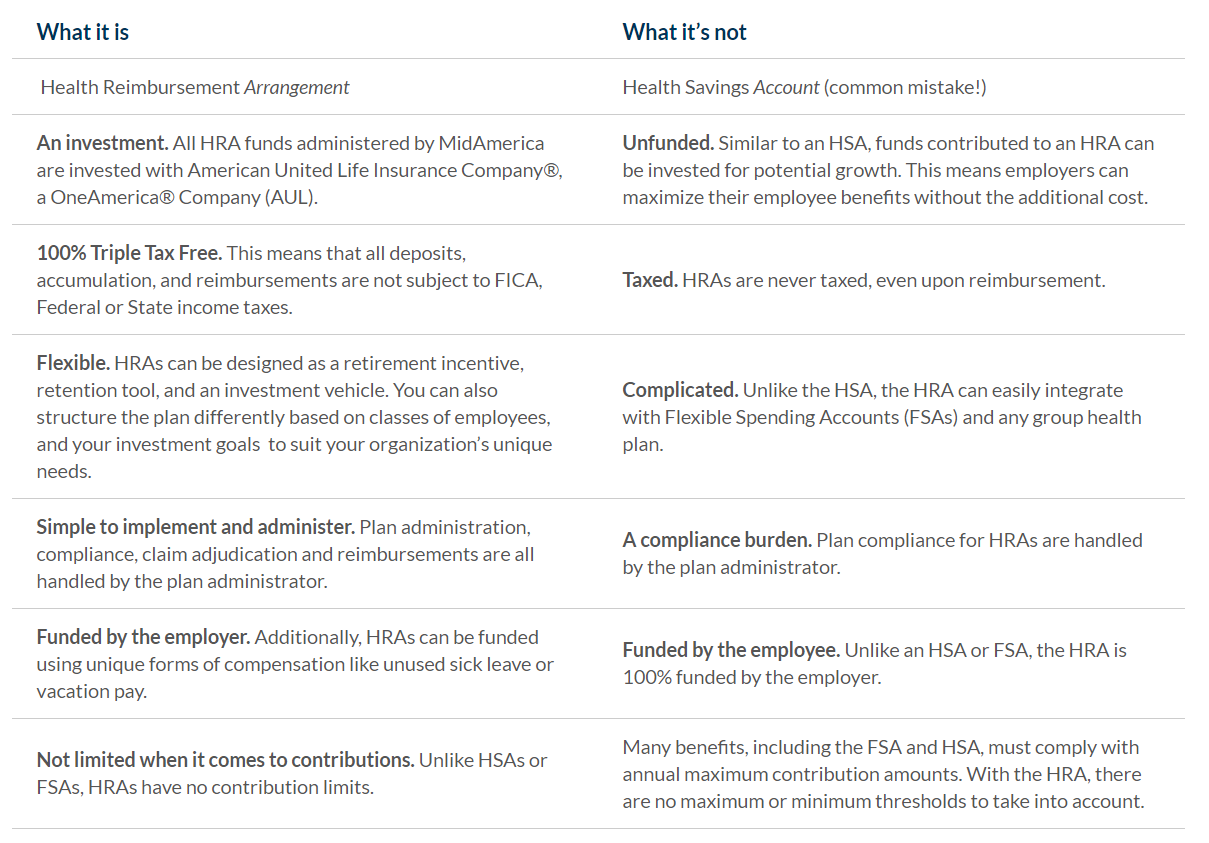

Other Common Misconceptions: What an HRA Is, And What It’s Not

No matter if you need help explaining your current HRA to your participants, or if you’re interested in implementing one, we’re here to help. MidAmerica can work with you to create a plan design that meets your unique needs and will assist in discussions about this valuable benefit. Simply reach out to your Account Representative or Account Manager to request additional details or to arrange a consultation.

If you’d like to learn more about the HRA, simply complete the form below!

Learn more about our HRA!

[1] https://www.investopedia.com/retirement/how-plan-medical-expenses-retirement/