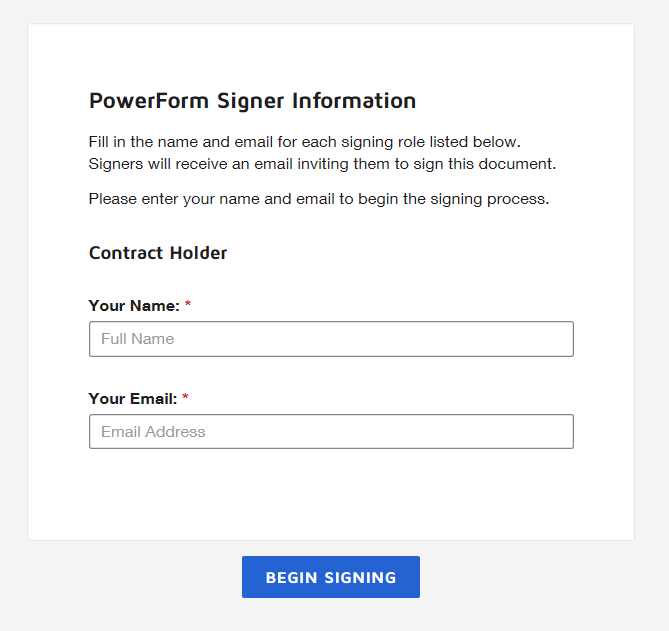

Signing the Amendment

I want to view the documents, but don’t want to enter my name and email as the signer. What do I do?

When you see the screen below, you can enter your name and email and select “Begin Signing” without following through with the signing process. This means you’ll be able to view the document, but can still exit out of the screen, thus not signing anything. You can also view a sample amendment by clicking here.

Who should the signer be?

We recommend speaking with your internal stakeholders to determine who the appropriate signer for your organization is. You received this email because you are listed as a contact for your employer group.

How do I forward this to the appropriate signer if it’s not me?

Simply forward the email to the individual who has signing rights. When they click the “View Your Contract Amendment” button, they can enter their information and execute the amendment(s).

What happens after I sign the amendment(s)?

Once you sign and return the contract amendment, you will receive the executed documents via email within 48 hours. The higher interest rate guarantee will go into effect within 20 business days of signing the amendment. Within that 20-business day time frame, there will be a brief plan maintenance period (approximately three business days) during which time no transactions or lineup changes can be made to participant accounts. We will provide notification of the plan maintenance period to you and your participants a week prior to maintenance.

About the Rate Increase

Why is AUL increasing the rate?

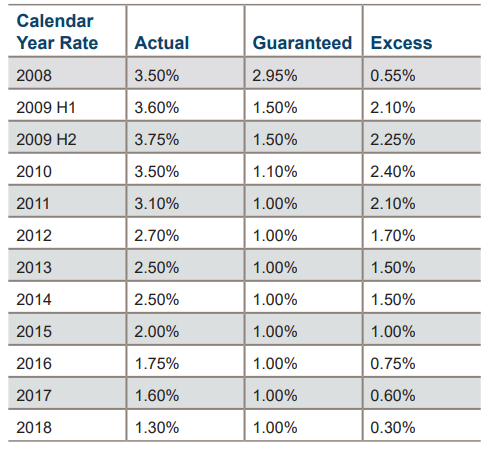

This update will allow AUL to continue its investment strategy which seeks to minimize the impact of short-term fluctuations and achieve optimal long-term returns and stability. Should AUL see higher yield in their long-term investments, they will consider paying an interest rate that is higher than the stated guaranteed minimum. AUL has a history of crediting rates above the minimum.

What changes does the contract amendment make?

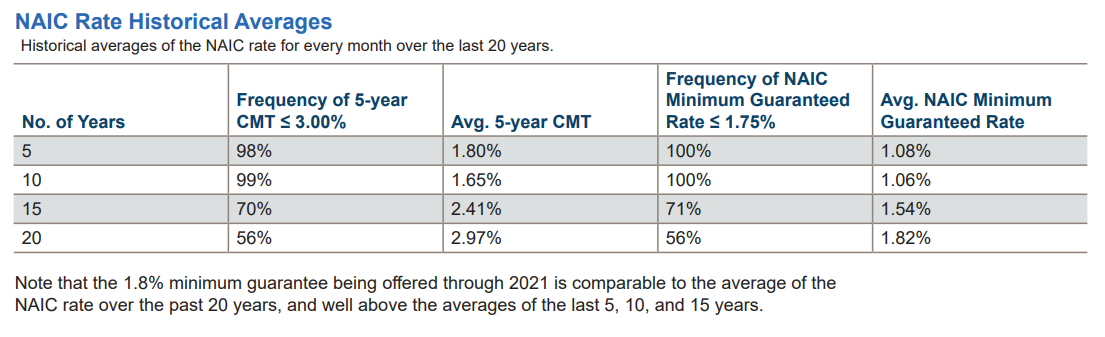

The contract amendment changes the minimum guarantee language in the American United Life Insurance Company® (AUL), a OneAmerica® company, Group Annuity Contract. Under the current contract, the minimum guaranteed interest rate is the greater of 1% or the NAIC rate. Under the amended contract, the minimum guaranteed interest rate will be a stated 1.8% through 2021. Thereafter, the minimum guaranteed interest rate will be 1%, though the actual credited rate could be higher.

Does this mean AUL will only be crediting 1% after 2021?

No. While 1% will be the minimum guaranteed interest rate, AUL has a strong history of crediting an interest rate higher than the minimum guarantee. The chart below details the actual rate which AUL credited along with the NAIC minimum interest rate.

How is the NAIC rate calculated?

The current guaranteed interest basis is described in your AUL Group Annuity Contract. In summary, the rate is derived by taking the average of the daily 5-year Constant Maturity Treasury (CMT) yield for the month of October and subtracting 1.25%. However, there is a lower and upper limit to the rate. On the low end, the NAIC rate is 1% and the high end is 3%. For 2019, guaranteed interest rate using this method is 1.75%.

Why does AUL want to remove the NAIC language?

The risk of quickly rising short term rates, even though they may not materialize, exposes AUL to significant risk. AUL invests in long-term bonds and mortgages to maximize the long-term return and stability of the product for its policyholders. In an effort to continue investing with this sound strategy in mind, removing the NAIC language allows AUL the ability to continue to do so without having to alter their investment strategy based on short-term fluctuations.

Under the amended contract, is there a cap on the credited rate, like the 3% cap on the NAIC?

No. If the interest rate environment continues to improve, AUL should see improved yield in their long-term investments which would allow them to credit rates above the minimum guaranteed interest rate. From 2008 to 2011, in an environment where long term yields were higher, AUL credited above 3%, even though short-term rates were much lower.

If there is a large increase in yields, how do I explain that to my board?

Assuming the credited rate is based on long term instruments, bonds, and mortgages, it’s possible the yield curve could invert (short term bond yields are greater than longer term bond yields). Currently, the spread between the 1yr and 10yr is only .55% apart and is well below historical averages. As a result, there are going to be periods where alternative products may appear more attractive. Over the past 10 years, it has been beneficial to be in an AUL group annuity as it has consistently outperformed money market investments and CDs. A main benefit of this amendment offer is the stability it provides for you and your plan participants through 2021 at an attractive and certain interest rate. While interest rate is a critical part of your benefit, it is coupled with excellent service. The acceptance of this amendment enables a seamless transition and allows us to focus on serving participants.

Is it possible CD or money market yields will be higher than the fixed annuity rate a year from now?

Yes. However, rapid movements between CDs, money market funds, and group annuity products aren’t sustainable administratively for group benefit plans. Frequent movements between investments lead to confusion amongst plan participants and can often result in frequent communications, plan blackout periods, and lower satisfaction in the plan. Rather, when evaluating investments, long term yields should be considered as there will be periods when the investments may outperform or underperform other investments. There is a significant benefit to offering a product that provides a strong rate of return while also providing certainty for the future.

How can other providers provide returns in excess of 1.8%?

- They are not as highly rated as AUL and do not have the same excellent track record of credited interest rate.

- Those rates are often more sensitive to market fluctuations—if the rate decreases, the rate for those products will

decrease more quickly as well.

Why should I accept this amendment?

- Product and rate certainty through 2021

- Working with an insurance company with among the highest ratings in the industry

- Downside protection—rate cannot go below 1.8% through 2021 regardless of any market interest rate declines

- Upside—if rates go up, AUL has the ability to credit rates above and beyond the minimum guarantee (which they have

demonstrated a strong track record of doing) - Stability—working with a benefit provider that focuses on white-glove service for employers and participants