The most common Health Reimbursement Arrangement questions we field are related to claim documentation requirements. Like many retirement and health care benefits, the HRA is regulated through the Internal Revenue Service (IRS). This means that, as your third-party administrator, MidAmerica must adhere to these IRS standards to make sure your plan stays protected and compliant. When you become claims-eligible and begin submitting reimbursement requests, we may follow up and ask for further documentation to verify and approve your claim. The majority of benefits debit card purchases are automatically approved without additional documentation; however, in some rare cases, we may ask for documentation to complete debit card transactions as well.

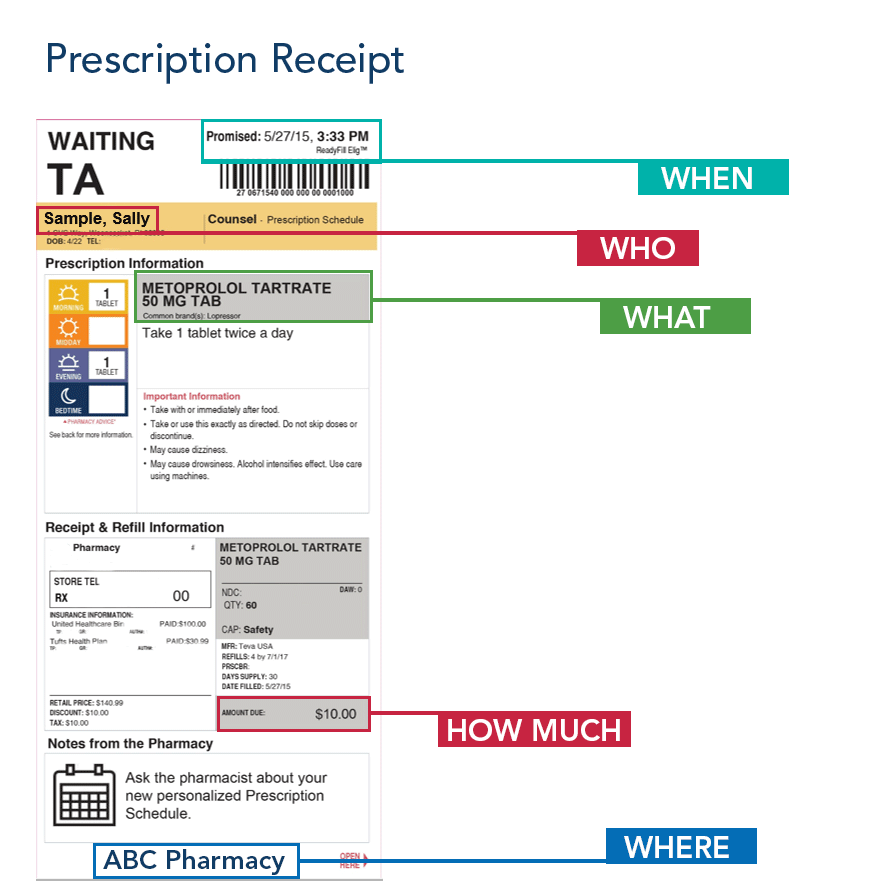

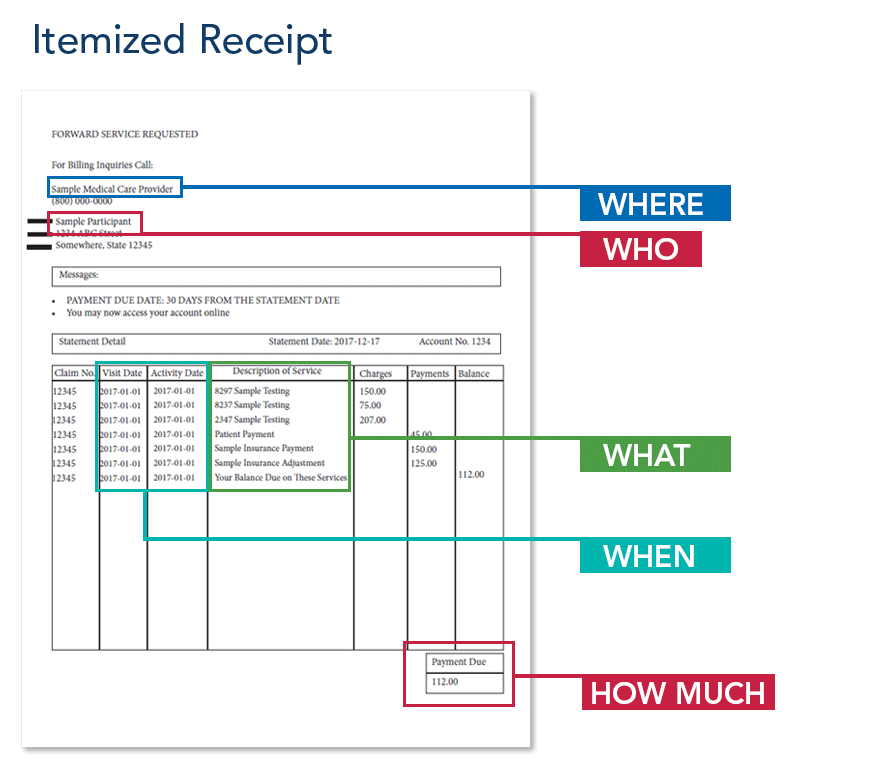

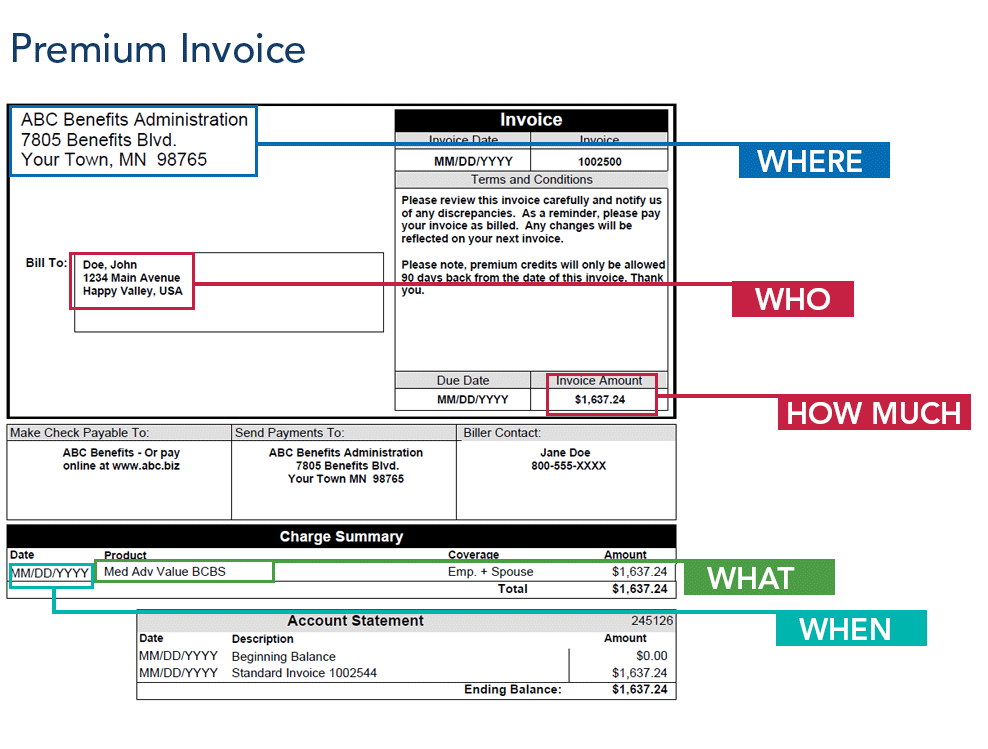

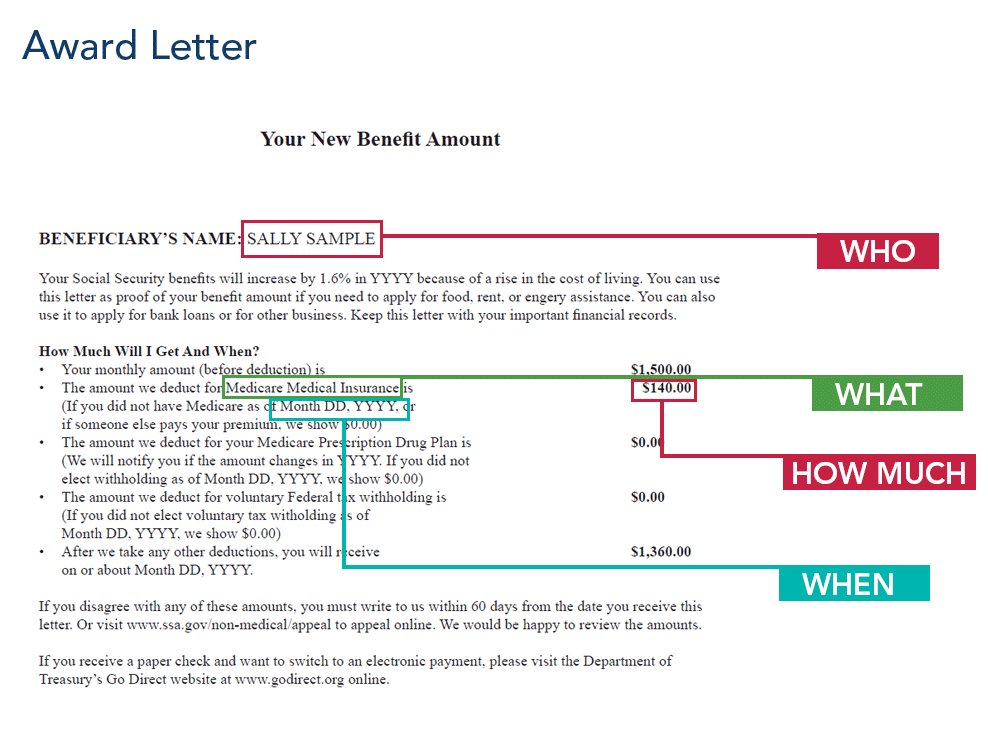

The who, what, when, where and how much of documentation.

Before you submit your claim for reimbursement, take a look at your corresponding documentation and verify that it includes these five elements. Below is a closer look at each key detail:

- Who: This is the name of the patient or, in the case of insurance premiums, the name of the insured person. This could be you, your spouse or an eligible dependent. Ultimately, to protect your benefit funds, we need to see who the medical expense is for.

- What: What is the medical expense? Is it an annual check-up, a prescription refill, or an insurance premium? Your documentation should include a description of exactly what type of medical expense you’re submitting for reimbursement.

- When – There should be some sort of date on the documentation you provide. This could be the date of medical service, the date your prescription was filled, or the coverage period for your insurance.

- Where – Where did you receive medical treatment? Where was your prescription refilled? The name of the provider or pharmacy should appear somewhere within your documentation. For premiums, make sure the name of the insurance carrier is also included.

- How much – How much did the medical expense cost? Your documentation should always include the cost of the service, item or premium you’re submitting for reimbursement.

Examples of Common Documentation

Having an HRA is an excellent way to cover the cost of eligible medical expenses—tax-free—for both you and your eligible dependents. Understanding what IRS-approved documentation looks like can make all the difference in your reimbursement experience and will help ensure a quicker processing time. If you have questions or need additional information, please call us at (855) 329-0095 or email us at healthaccountservices@myMidAmerica.com. We’re always here to help.

Important note on eligible expenses, reimbursement eligibility and debit card access: Eligible expenses, access to reimbursement funds and debit card accessibility under your HRA can vary depending on plan design. For more information on your unique HRA, review the Plan Highlights included with the Welcome Kit you received upon entering the plan.